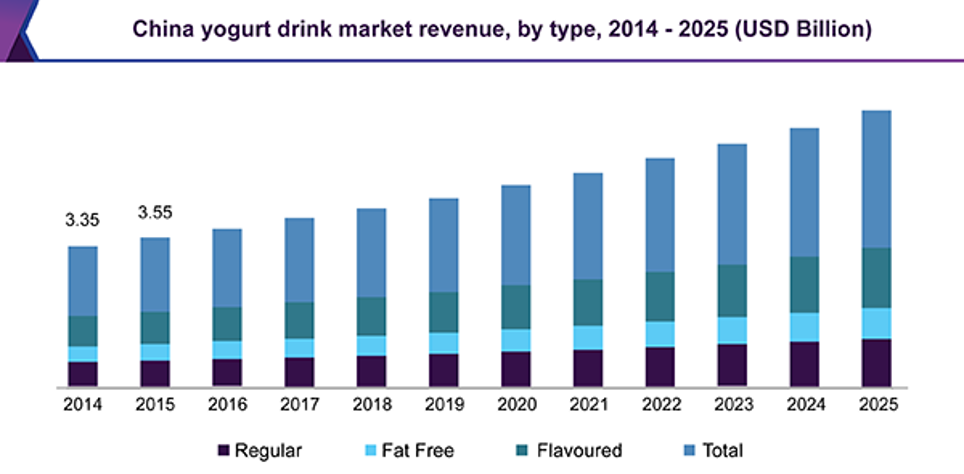

The size of the global market for yoghurt drinks had already reached, in a global context, 29.19 billion Dollars in 2016, with a considerable increase during recent years.

Thanks to increased consumer awareness of their health benefits, it is expected that consumption of these products will continue to grow in future years[1].

The further increase in the global yoghurt drink market

In various parts of the world, in particular North America and the Asian Pacific macro-area, there is a tendency to promote yoghurt as an essential drink for good health, and this approach should further fuel market growth.

In light of this overall situation, manufacturers of dairy products are equipping themselves to guarantee an adequate supply of raw materials destined for the production of yoghurt drinks.

Among the reasons for the growth of this type of product is also an increase in the fight against consumption of foodstuffs with a high sugar content, a factor that - as we know - results in the spread of various pathologies, from obesity to cardiovascular disease.

This trend favours the market for fat-free drinks, including yoghurt drinks, in the short, medium and long term.

Furthermore, the recent trend of offering new ranges of fat-free products with a low sugar content has also grown due to the increase in the population of those suffering from various forms of diabetes.

Read Also: "Packaging for yoghurt drinks: how to optimise production"

Yoghurt drink packaging materials

Changes in lifestyle have caused a large number of people to opt for products that can be transported easily outside the home, something that has resulted in a further boom in the consumption of yoghurt drinks, although the majority of consumers prefers to consume them fresh from the refrigerator (at approximately 4 °C).

Regarding packaging materials for yoghurt drinks, the market is divided between plastic (mainly PP and PS), making up approximately 64%, with the remaining part being occupied by polylaminate cardboard solutions.

In both cases these containers are non-transparent, mainly for two reasons:

- Non-transparent containers protect the product from the light: this is because yoghurt drink, like the majority of dairy products, is photosensitive and contact with light might result in oxidation of the fatty part;

- the lack of transparency also has the function of hiding from the final consumer something that is seen as an aesthetically unattractive feature, that is to say the separation and subsequent rising to the surface of cream.

This is not a defect, but a characteristic common to products that involve the addition of water, resulting in the creation of two layers of product inside the packaging.

This makes the product less appetising, so the lack of transparency helps the sales process. The recommendation to “shake well before use”, which appears among the consumer information, allows the product components to be combined.

Apart from these aspects, polypropylene and polystyrene are the most widely used types of packaging, although recently PET is also entering this product sector.

PET has the advantage of being able to integrate bottle production and filling, offering a cleaner solution that is more suitable for this type of product. An even more advantageous solution was recently presented on the market, which starts from the production of preforms and finishes with the filled and capped bottle, in a single system.

Technical Study: "PET lightweighting: how to safeguard the strength of bottles"

The mechanical properties of PET, which are higher than other plastics, also allow a reduction in the weight of the container, thus decreasing the cost of packaging, which is fully recyclable and therefore in line with the idea of a circular economy.

[1] Global Industry Report, 2018-2025